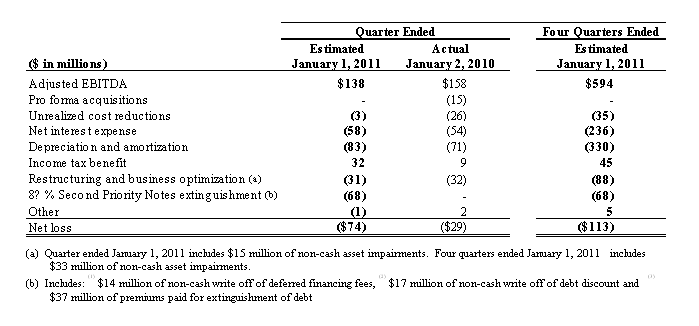

EVANSVILLE, IN - February 1, 2011 - Berry Plastics Corporation (the 'Company') estimates that its net sales will total approximately $1,041 million during its fiscal 2011 first quarter, representing an increase of 18% over $880 million in the fiscal 2010 first quarter. This increase is a result of acquisition volume growth attributed to the acquisitions of Pliant and Superfos of 20% and net selling price increases of 5% partially offset by a base volume decline of 7%. The base volume decline is primarily attributed to the quarterly period ended January 1, 2011 being a thirteen week period compared to a fourteen week period for the quarterly period ended January 2, 2010, and decreased sales in our retail trash bag and retail sheeting product lines. Also, the Company estimates that its fiscal 2011 first quarter Adjusted EBITDA will be approximately $138 million compared to $158 million for the first fiscal quarter of 2010. These amounts reflect management’s estimate as of the date of this press release; actual results may vary from these results. Adjusted EBITDA is a Non-GAAP measure. The following table reconciles our Adjusted EBITDA to net loss:

Adjusted EBITDA is a financial metric utilized in the calculation of the first lien leverage ratio as defined in the Company's senior secured credit facilities. While the determination of appropriate adjustments in the calculation of Adjusted EBITDA is subject to interpretation under the terms of the credit facility, management believes the adjustments described above are in accordance with the covenants in the credit facility. Adjusted EBITDA should not be considered in isolation or construed as an alternative to our net loss or other measures as determined in accordance with GAAP. In addition, other companies in our industry or across different industries may calculate bank covenants and related definitions differently than we do, limiting the usefulness of our calculation of Adjusted EBITDA as a comparative measure.

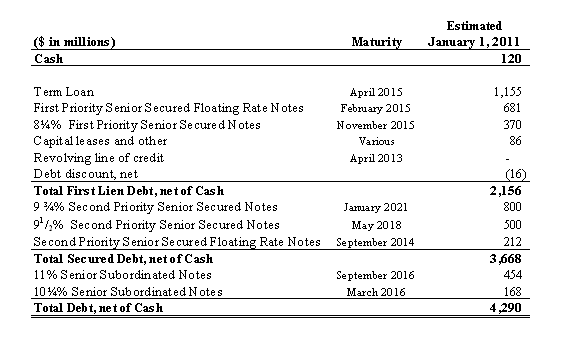

At January 1, 2011, the Company had no outstanding balance on the revolving credit facility, approximately $120 million of cash and unused borrowing capacity of approximately $444 million under the revolving line of credit subject to the solvency of our lenders to fund their obligations and our borrowing base calculations.

The Company's estimated outstanding debt consisted of the following as of January 2, 2011.

This press release is for informational purposes only and is not intended to serve as a solicitation to buy securities or an offer to sell securities.

Berry Plastics is a leading manufacturer and marketer of plastic packaging products and is headquartered in Evansville, Indiana.

# # #

Certain statements and information included in this release may constitute "forward looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Berry Plastics to be materially different from any future results, performance, or achievements expressed or implied in such forward looking statements. Additional discussion of factors that could cause actual results to differ materially from management's projections, forecasts, estimates and expectations is contained in the company's SEC filings. The company does not undertake any obligation to update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.